S&P 500 Index lost 10.8% in 1957, so Buffett’s investors actually thrilled to beat the market by 20.1 percentage points in 1957.īetween 19 Warren Buffett’s hedge fund returned 23.5% annually after deducting Warren Buffett’s 5.5 percentage point annual fees. That year Buffett’s hedge fund returned 10.4% and Buffett took only 1.1 percentage points of that as “fees”. His investors didn’t mind that he underperformed the market in 1958 because he beat the market by a large margin in 1957. That would have been 9.35% in hedge fund “fees”.Īctually Warren Buffett failed to beat the S&P 500 Index in 1958, returned only 40.9% and pocketed 8.7 percentage of it as “fees”. secretly invested like a closet index fund), Warren Buffett would have pocketed a quarter of the 37.4% excess return. If Warren Buffett’s hedge fund didn’t generate any outperformance (i.e. Warren Buffett took 25% of all returns in excess of 6 percent.įor example S&P 500 Index returned 43.4% in 1958.

Back then they weren’t called hedge funds, they were called “partnerships”. He launched his hedge fund in 1956 with $105,100 in seed capital. Warren Buffett never mentions this but he is one of the first hedge fund managers who unlocked the secrets of successful stock market investing.

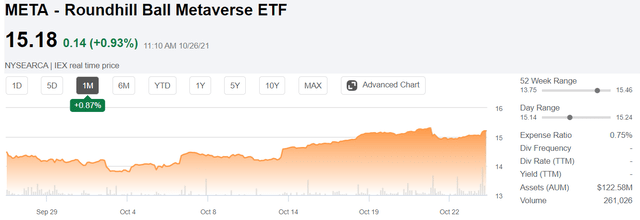

#ROUNDHILL BALL META ETF FULL#

However, given our thesis that full interoperability is somewhat unrealistic, it’s easy to see how Roblox fits the definition…( click here to read the full text ) Roblox actually has a lot of the pieces for our utopian definition of Metaverse, but things like technology, interoperability with outside platforms and a dynamic, two-way economy are what’s missing.

#ROUNDHILL BALL META ETF PROFESSIONAL#

The developer community has the capability to build tools for other developers, there are professional studios being built on the platform and many consumer-facing brands/content are partnering with Roblox to ensure a virtual presence. Roblox talks a lot about platform extension, which would move the platform beyond just gaming/leisure experiences and into education and workplace offerings. In addition, many of the items that you purchase in the avatar marketplace, or even a branded experience like Vans World, can be taken across experiences. The content is almost entirely user generated, the engine that powers the developer studio is provided by Roblox and developers/creators share in almost all the money that users spend on the platform. We expect new multi-billion dollar companies will rise as the Metaverse becomes more mature. These are the large capitalized players in the space but albeit, not the only ones. In augmented reality, it would be Niantic and SNAP. On the virtual side, we’d point to companies like Epic Games, TakeTwo and Roblox. “If we look at the Metaverse concept with more lenient guidelines for interoperability, then it becomes easier to see why certain companies are being referred to as Metaverse. Here is what Jefferies Group has to say about Roblox Corporation (NYSE:RBLX) in its Q3 2021 investor letter: Tiger Global Management was the biggest stakeholder of the company in the third quarter, with 17.4 million shares worth $1.3 billion. In Q3 2021, 50 funds were bullish on Roblox Corporation (NYSE:RBLX), with collective stakes amounting to $3.5 billion. Roblox Corporation (NYSE:RBLX) is a popular stock among elite hedge funds.

0 kommentar(er)

0 kommentar(er)